If you haven't noticed, there is a group of six stocks that's been on fire this year.

The best performer is up 3,233% since its December 2008 lows. Yes, you read that correctly. . . +3,233%.

Another one is up 990% in that same time. Three other stocks ― all microcaps ― are up 1,100%, 2,125%, and 1,999%.

The worse performer of the bunch, a large cap, is up just 21% since December.

The six stocks have just one thing in common: all produce or mine lithium.

Lithium is being touted as the next primary fuel of the 21st century. Hybrid technology and electric cars are thought to be a viable alternative. I have no idea how long it will take to fully transform the U.S. economy from a fossil-based energy complex to a renewable one, but I do know this. . . sentiment is clearly in favor of green energy.

Solar energy, wind, clean fuels, ethanol, run of river projects, and geothermal energy continue to be the hot topic in the energy sector. So if the world moves forward to battery-driven vehicles, lithium will be a high-in-demand commodity, as it is used in electric and hybrid electric car batteries.

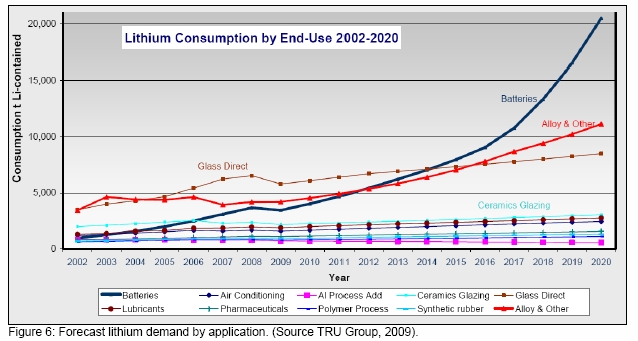

The following chart shows the estimated future lithium consumption:

With the rest of the nation in recession, one state is enjoying a real live oil boom.

It's all happening in North Dakota, where the Bakken -- a massive oil formation -- has already become a major force in our domestic energy picture.

And now, geologists tell us, we may be looking at a "second Bakken"... one that could easily double the Bakken's 4.3 billion barrels of recoverable oil.

Read on to learn more about what's being called "the #1 oil play in the country"... and the profit-making stocks behind it.

According to a report recently published by Research and Markets entitled "Lithium-Ion and Nickel-Metal Hydride Batteries, Lithium, Rare Earth Lanthanum and the Future of Hybrid Electric Vehicles 2009-2020":

The auto industry is about to enter a new era: the electrification of cars. The move to electrified cars will have dramatic, disruptive consequences to consumers, auto makers, input suppliers, battery producers, regulators, mining companies, oil producers, electric utilities, R&D activities and investors, among others. However, from this change will come enormous opportunities, including the reduction in CO2 and global warming, less dependence on oil, more geopolitical independence, technological advancements, very large, new industries and markets, and huge profits.

The economic, regulatory and technological advantages of hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs) and electric vehicles (EVs) means that dramatic growth in their adoption and usage will be seen over the next 11 years to 2020, both in the US and worldwide.

Batteries are the key technology enablers for the future of HEVs, PHEVs and EVs. Nickel-metal hydride (NiMH) batteries currently dominate the HEV market, but they soon will be replaced by lithium-ion ones.*

*Editor's emphasis

During the uranium bull market between 2001 and 2007, more than 600 uranium companies either went public or switched their resource business to become a uranium play.Six hundred companies!

And less than 10 actually mined proven uranium.

Yes, it was mania.

Even though the lithium stocks are up big in the past year, the supply of stock available to investors is severely small.

We could be witnessing the phenomenon of "too many dollars chasing too few stocks."

The lithium bull market is in its infancy. If it's similar to the uranium bull market, we could witness several years of a lithium rally.

In the coming weeks, I will be recommending lithium stocks to you.

No comments:

Post a Comment